Section 179 - 2024

Maximize Your 2024 Tax Savings with Section 179

Keep Your Money!

Section 179 of the IRS tax code offers unique benefits to business owners, making your new vehicle purchase even more rewarding! For 2024, you can reduce your tax liability by purchasing eligible vehicles and taking advantage of this incredible deduction. Business owners may write off up to 100% of the purchase price for qualifying vehicles as long as they are used for business purposes more than 50% of the time.

Act now! This opportunity applies to vehicles placed in service during the 2024 calendar year.

Tax Write-Off Examples for Qualifying Small Businesses:

Tax Treatment | Applies To | Eligible Vehicles |

|---|---|---|

Write off up to the entire purchase cost on your 2024 IRS tax return.* | Trucks (>6-ft. bed length) and cargo vans rated greater than 6,000-lbs GVWR | Examples include full-size trucks and commercial cargo vans. |

Write off up to $30,500 of the purchase cost, plus 60% Bonus Depreciation on any remaining balance on your 2024 tax return.* | Passenger trucks (<6-ft. bed length), vans, and SUVs rated greater than 6,000-lbs GVWR | Examples include smaller trucks, passenger vans, and large SUVs. |

Important Notes:

While spending caps and bonus depreciation rules have applied in the past, IRS regulations are subject to updates. For 2024, focus on Section 179’s significant benefit of allowing 100% deductions for qualifying vehicles.

Not all vehicles are eligible for Section 179. Visit www.irs.gov for more information.

Inventory

Shop Our Inventory

Kruse Motors offers the best from Ford, Lincoln, Buick, and GMC as well as a great selection of pre-owned options!

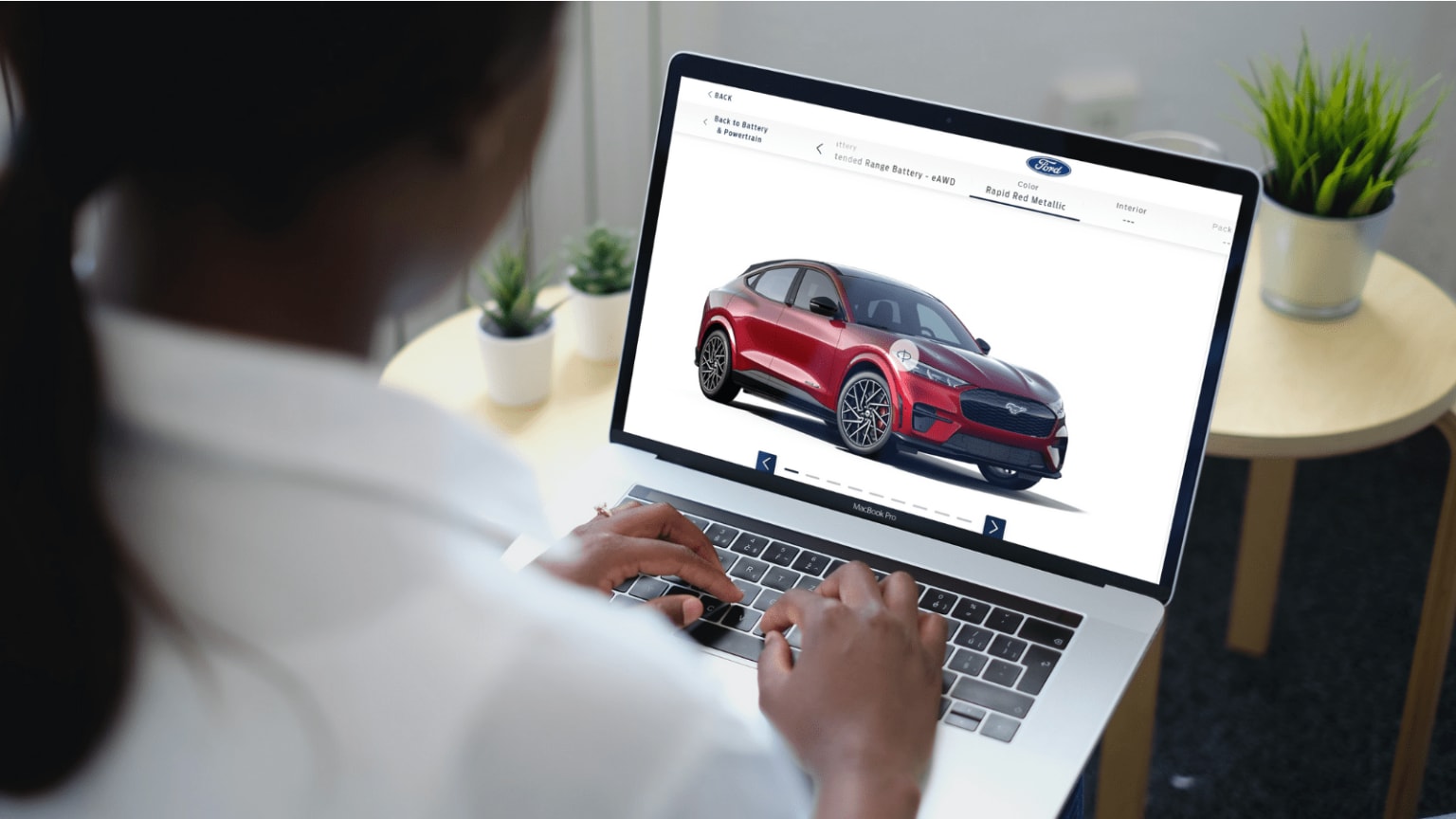

Vehicle Pre-Order

Build it so you can buy it. With inventory shortages, this is how you can ensure you get what you want out of your next vehicle!

We're Here to Help

Contact us today to find out how your vehicle of choice could help you save big on your 2024 taxes!

The information supplied here is provided by Kruse Motors as a public service to its customers. It should not be construed as tax advice or a promise of potential tax savings. Individual tax situations may vary, and federal tax rules are subject to change. For more information about Section 179 or other business vehicle expense write-offs, consult your tax advisor or visit the IRS website at www.irs.gov.